Abuja, Nigeria — In a move that underscores the delicate balancing act between stimulating economic growth and controlling inflation, the Central Bank of Nigeria (CBN) has announced a reduction of its benchmark interest rate by 50 basis points, bringing it down from 27.5% to 27%.

The decision, which followed the conclusion of the Monetary Policy Committee (MPC) meeting on Monday, has sparked widespread reactions from economists, financial analysts, investors, and business owners across the country. While some stakeholders view it as a cautious but welcome shift toward monetary easing, others argue that the reduction is too modest to significantly impact lending, investment, and overall economic activity.

The Rationale Behind the Cut

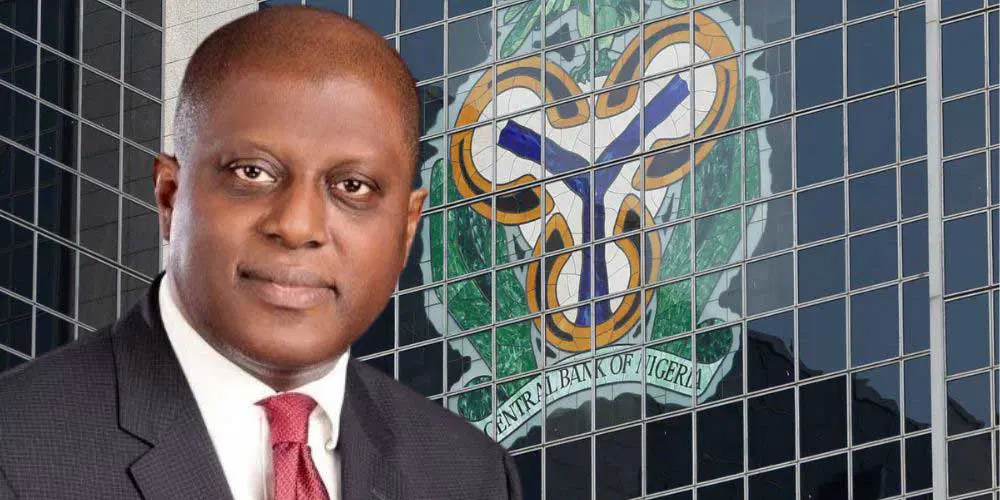

The CBN Governor, while briefing journalists after the MPC meeting, explained that the move was guided by the Bank’s dual mandate of maintaining price stability and supporting economic growth. Nigeria has been grappling with stubbornly high inflation rates, which peaked above 30% earlier in 2025, making borrowing costs painfully high for businesses and consumers alike.

“This reduction is intended to stimulate lending to the real sector, support job creation, and encourage investment, while ensuring that inflationary risks are properly managed,” the Governor said.

The cut marks the first time in several months that the apex bank has eased monetary policy. For much of 2024 and 2025, the CBN had adopted an aggressive tightening stance, hiking interest rates to record levels to rein in galloping inflation. The decision to trim the Monetary Policy Rate (MPR) therefore signals that the Bank sees some scope for easing without jeopardizing its inflation-fighting efforts.

Interest Rates and Nigeria’s Inflation Challenge

Nigeria has long battled the scourge of inflation, driven by a mix of structural and cyclical factors. Food inflation, in particular, has been a major concern, fueled by insecurity in farming regions, high transportation costs, and currency depreciation.

With headline inflation hovering in the high double digits, the CBN had little choice in previous months but to keep rates elevated, even as businesses complained about prohibitive borrowing costs. The cut to 27%, while small, suggests that the Bank is cautiously optimistic about inflation stabilizing in the coming months.

Economists say that the latest move reflects a delicate balancing act. On one hand, the high rate has discouraged speculative demand for foreign exchange and anchored expectations. On the other, it has also constrained economic growth by limiting access to affordable credit for small businesses and households.

Market Reactions and Investor Sentiment

Reactions to the CBN’s announcement have been mixed. Financial analysts describe the 50 basis point cut as largely symbolic, arguing that at such high interest rate levels, the practical effect on lending conditions may be minimal.

“This is a cautious step, not a game-changer,” said a Lagos-based investment banker. “At 27%, borrowing is still extremely expensive for the private sector. The cut sends a positive signal, but it will take much more before businesses feel real relief.”

Equity investors, however, have reacted positively, with many predicting that the stock market could experience a short-term boost as lower rates improve the outlook for corporate earnings. Similarly, government bond yields may adjust slightly downward as investors anticipate more monetary easing in the future.

The naira’s performance will also be closely watched in the days ahead. A rate cut typically puts pressure on the domestic currency by reducing returns for foreign investors, but analysts believe that the CBN’s cautious approach will mitigate any sharp depreciation.

Implications for Businesses

For Nigeria’s struggling private sector, the announcement offers a glimmer of hope. Manufacturers, traders, and service providers have long complained that high borrowing costs make it difficult to expand operations or sustain growth.

With the MPR now at 27%, commercial banks are expected to adjust their lending rates, though the extent of the adjustment remains uncertain. Many banks typically add a significant premium to the policy rate when offering loans, meaning that effective lending rates could still exceed 30%.

“Even with the cut, accessing credit remains out of reach for most small and medium enterprises,” noted an Abuja-based entrepreneur. “What we need is not just lower interest rates but also targeted intervention funds that can directly support productive sectors.”

The real estate sector, long affected by high financing costs, may also experience a slight rebound. Developers and mortgage providers hope that lower rates will stimulate demand for housing loans and construction financing, though the impact will likely take time to materialize.

Impact on Households

For Nigerian households, the effect of the CBN’s move will be felt in two key ways: access to credit and cost of living.

On the credit side, personal loans, auto loans, and mortgages may become marginally more affordable if commercial banks pass on the rate reduction to consumers. However, with inflation still eating into disposable incomes, many households remain cautious about taking on new debt.

On the cost-of-living front, lower interest rates could support broader economic activity, potentially easing some price pressures over time. Still, much depends on external factors such as global oil prices, exchange rate stability, and food supply chains.

Expert Opinions

Economists and policy experts are divided on whether the CBN should have been bolder in its approach. Some argue that a deeper cut was necessary to unlock credit flows and stimulate growth, while others warn that loosening too quickly could reignite inflation.

“The 50 basis point cut is a signal, not a solution,” said one monetary policy expert. “It tells the market that the CBN is open to easing, but it also reminds us that inflation is still a clear and present danger.”

Another analyst emphasized the importance of complementary fiscal policies. “Monetary policy alone cannot solve Nigeria’s economic challenges. The government must address structural issues like power supply, infrastructure, and insecurity in food-producing regions. Without these reforms, interest rate adjustments will have limited impact.”

The Road Ahead

Looking forward, the CBN is expected to take a gradualist approach, monitoring inflation and growth indicators closely before making further rate adjustments. The Bank has signaled that its ultimate objective is to achieve price stability while fostering sustainable economic expansion.

Market participants will be watching closely for future signals from the MPC, particularly whether additional cuts may be on the horizon in 2026. Much will depend on inflation trends, foreign exchange stability, and the fiscal direction of the federal government.

Conclusion

The Central Bank of Nigeria’s decision to lower the interest rate by 50 basis points to 27% marks a cautious but important step in its ongoing effort to balance growth and inflation. While the cut may not dramatically alter lending dynamics overnight, it signals a shift in tone and a willingness to support the economy after months of restrictive monetary policy.

For businesses and households, the move offers a measure of optimism, even if challenges remain. For policymakers, it highlights the urgent need for coordinated efforts between monetary and fiscal authorities to address Nigeria’s deep-rooted structural challenges.

Ultimately, whether this modest rate cut translates into tangible benefits for Nigerians will depend on the broader economic environment, the response of commercial banks, and the government’s ability to complement monetary policy with decisive fiscal reforms.