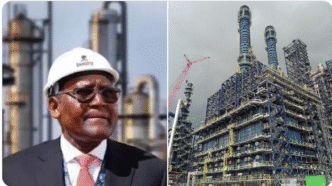

The Dangote Petroleum Refinery has announced the suspension of petrol sales in naira, a decision that has unsettled fuel marketers and reignited fears of price volatility in Nigeria’s downstream sector.

In an email circulated to customers at 6:42 p.m. on Friday, the refinery disclosed that the suspension would take effect from Sunday, September 28, 2025. The company explained that it had exhausted its crude-for-naira allocation, leaving it unable to sustain petrol sales in the local currency.

The notice, signed by the Group Commercial Operations of Dangote Petroleum Refinery & Petrochemicals, was titled “Suspension of DPRP PMS Naira Sales – Effective 28th September 2025”. It further instructed customers with ongoing naira-based transactions to apply for refunds.

“We write to inform you that Dangote Petroleum Refinery & Petrochemicals has been selling petroleum products in excess of our Naira-Crude allocations and, consequently, we are unable to sustain PMS sales in Naira going forward,” the statement read. “Kindly note that this suspension of Naira sales for PMS will be effective from Sunday, 28th of September, 2025. We will provide further updates regarding the resumption of supply once the situation has been resolved. All customers with PMS transactions in Naira who would like a refund of their current payments should formally request the processing of their refund.”

This latest development comes as the refinery faces mounting labour disputes. On Friday, the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) accused the company of sacking more than 800 Nigerian workers for joining the union. The association described the move as “anti-labour” and vowed to resist what it called an “unjust and insensitive corporate decision.” It has threatened nationwide solidarity actions if the matter is not resolved.

Industry watchers note that this is not the first time the refinery has suspended sales in naira. In March 2025, Dangote briefly halted such transactions, citing insufficient crude-for-naira allocations to meet growing domestic demand. That decision stoked concerns about the dollarisation of fuel sales, pushing pump prices close to N1,000 per litre.

Analysts warn the latest suspension could produce similar ripple effects. Jeremiah Olatide, Chief Executive Officer of Petroleumprice.ng, cautioned that petrol prices might again climb above N900 per litre if marketers are forced to transact in dollars. He noted that the refinery had been instrumental in moderating petrol prices in recent months, making its role critical to Nigeria’s fuel stability.

The twin challenges of naira sales suspension and industrial unrest have raised broader questions about energy security. With Dangote Refinery positioned as a cornerstone of Nigeria’s fuel supply, stakeholders fear the unfolding crisis could undermine government reforms aimed at stabilising the downstream market.

As Nigerians brace for possible disruptions, all eyes remain on both the company and federal authorities to determine how quickly the situation will be resolved and whether lasting solutions can be found to prevent further shocks to the country’s fragile fuel sector.