ABUJA, October 23, 2025 — Fresh industry data have revealed that Nigeria imported about 15 billion litres of petrol (Premium Motor Spirit, PMS) between August 2024 and October 2025, despite the commencement of domestic petrol production by the Dangote Petroleum Refinery.

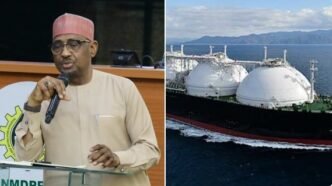

The report, obtained from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), highlights the country’s continued reliance on imported refined products to meet local demand, even as the nation’s refining capacity grows.

According to the data, the total petrol supply for the 15-month period stood at approximately 21.68 billion litres, out of which 6.67 billion litres were produced locally. This means that 69 percent of Nigeria’s petrol supply during the period still came from imports, while domestic refineries, including the Dangote plant, accounted for just 31 percent.

Petrol Imports Continue Despite Dangote Refinery Operations

The figures underscore the paradox of Africa’s largest crude oil producer still depending heavily on imported petrol even after the launch of one of the world’s largest single-train refineries.

The Dangote Refinery, with a capacity of 650,000 barrels per day, began supplying petrol to the local market in September 2024 following months of test runs and regulatory approvals. However, the refinery is still in the process of ramping up to full operational capacity.

Industry officials say that while the refinery’s start-up marked a turning point in Nigeria’s energy history, logistical challenges, supply chain limitations, and the gradual nature of its scale-up have meant that the country continues to import substantial volumes of petrol to meet national consumption needs.

Breakdown of Supply Trends

According to the NMDPRA’s market analysis, imported petrol volumes peaked at about 54 million litres per day in September 2024, the same month Dangote Refinery commenced domestic supply.

By January 2025, imports had reduced significantly to 24 million litres per day, reflecting the early impact of the refinery’s production. As of October 2025, the daily import average had dropped further to 15 million litres, with domestic refineries contributing approximately 20 million litres per day.

This indicates that while imports are decreasing, they still form a large portion of Nigeria’s daily petrol supply, estimated at 35 million litres per day nationwide.

An NMDPRA official, who spoke under condition of anonymity, said the decline in import volumes is expected to continue as the Dangote Refinery and other modular refineries expand their output.

“We are witnessing a gradual but steady transition from import dependency to domestic self-sufficiency. However, the process will take time because production, distribution, and pricing structures must stabilize before full substitution occurs,” the official said.

Why Nigeria Still Imports Petrol

Experts have identified several reasons why Nigeria continues to import petrol despite domestic refining capacity coming online:

- Refinery Ramp-Up Period:

The Dangote Refinery is still undergoing capacity optimization. While it has started producing petrol, it is not yet operating at full production levels due to ongoing calibration and technical adjustments. - Feedstock Challenges:

In recent months, reports indicate that the refinery has faced intermittent crude supply disruptions. Nigeria’s upstream sector, plagued by pipeline vandalism and oil theft, has occasionally hindered the consistent flow of crude to the plant. - Distribution and Logistics Issues:

Transporting refined petrol from the refinery to various depots across the country remains a challenge due to inadequate pipeline infrastructure and security concerns on major routes. - Market Transition Dynamics:

Oil marketers have existing import contracts and financial commitments that cannot be terminated immediately. The gradual shift to domestic sourcing must align with contractual and financial realities. - Economic Factors:

Fluctuating exchange rates, global oil prices, and domestic inflation have complicated pricing dynamics for both imported and locally produced petrol, prompting marketers to hedge their risks through diversified sourcing.

Economic Implications of Continued Importation

Nigeria’s heavy reliance on imported fuel continues to place enormous pressure on foreign exchange reserves, as petroleum products are among the largest contributors to the country’s import bill.

The Central Bank of Nigeria (CBN) has frequently expressed concerns that persistent fuel imports undermine efforts to stabilize the naira, increase inflationary pressures, and contribute to trade deficits.

Analysts say that while the Dangote Refinery’s operations have started reducing import demand, the full economic benefits will only materialize once domestic refining fully meets local consumption.

Dr. Emmanuel Ejezie, an energy economist based in Lagos, described the situation as “a transitional reality.”

“The refinery has started well, but it takes time to ramp up operations, stabilize yields, and distribute efficiently. The key advantage is that Nigeria is now on a pathway toward self-sufficiency, something it has lacked for decades,” Ejezie noted.

Impact on Consumers and Fuel Prices

Despite the gradual increase in domestic production, consumers have yet to see significant relief in pump prices. Petrol currently sells between ₦650 and ₦700 per litre, depending on location and supply conditions.

Experts believe that while local production may reduce transportation costs and supply risks, fuel prices will continue to be influenced by broader market forces, including crude oil prices, foreign exchange rates, and subsidy considerations.

There are also ongoing debates within government circles about whether to reintroduce limited fuel price stabilization mechanisms to cushion citizens from price volatility during the market transition.

Government’s Position and Policy Response

The federal government has reiterated its commitment to achieving fuel self-sufficiency through domestic refining.

Speaking earlier this month, Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri, stated that Nigeria’s refining capacity will soon exceed its daily consumption once Dangote and the rehabilitated Port Harcourt Refinery reach full operations.

“The Dangote Refinery is a game changer. We are confident that by the end of 2025, Nigeria will not only meet its local fuel demand but also become a net exporter of refined products,” Lokpobiri said.

The government is also pushing for improved crude supply coordination between the Nigerian National Petroleum Company Limited (NNPC) and local refineries to prevent disruptions.

The Road Ahead: Toward Energy Independence

While Nigeria’s 15 billion litres of imported petrol may seem alarming, experts say the trend reflects a transitional period in the country’s energy sector.

The gradual decline in imports and increase in local production demonstrate the impact of the Dangote Refinery’s entry into the market. With continued operational optimization, additional modular refineries, and better crude supply management, Nigeria could achieve near-complete fuel independence within the next two years.

To sustain progress, industry observers have urged the federal government to:

- Strengthen pipeline infrastructure for crude and refined products.

- Ensure transparent pricing mechanisms to attract investment.

- Improve regulatory stability to encourage private-sector participation.

- Support local refineries through consistent feedstock allocation.

Conclusion

The revelation that Nigeria imported 15 billion litres of petrol despite having operational domestic refining capacity underscores the complexity of the country’s energy transition.

Although the Dangote Refinery has made remarkable progress, full self-sufficiency remains a work in progress. The refinery’s increasing contribution to domestic supply is already reducing import dependency, but Nigeria must address logistical, infrastructural, and policy challenges to unlock the full benefits.

As the country moves toward 2026, the goal of ending petrol importation entirely appears within reach — but only if government coordination, refinery optimization, and energy sector reforms continue at full pace.