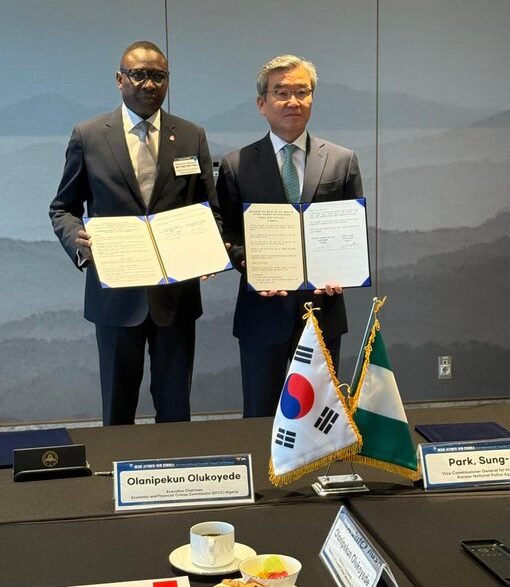

In a bold move to strengthen global cooperation against financial crimes and cyber-enabled fraud, the Economic and Financial Crimes Commission (EFCC) of Nigeria has signed a groundbreaking Memorandum of Understanding (MoU) with the Korean National Police Agency (KNPA). The agreement, sealed on Saturday, underscores Nigeria’s growing commitment to international partnerships in addressing the complex and borderless nature of modern financial crimes.

The deal is expected to focus on intelligence sharing, joint investigations, capacity building, and the deployment of advanced digital forensic tools, creating a stronger framework for tackling money laundering, internet fraud, cryptocurrency scams, and other transnational financial offenses.

EFCC Chairman Hails New Era in International Collaboration

Speaking during the official signing, EFCC Chairman Ola Olukoyede described the partnership as a landmark achievement that reflects Nigeria’s seriousness in combating economic and financial crimes.

“Fraudsters and cybercriminals are exploiting international systems to launder money and perpetrate scams. This MoU with the Korean National Police Agency is an important step towards sharing intelligence, building capacity, and ensuring that no safe haven exists for criminals,” Olukoyede said.

According to him, the MoU will also boost Nigeria’s credibility among global financial institutions and investors who demand assurances of transparency and accountability.

Korean National Police Agency Recognizes Nigeria’s Strategic Role

Representatives of the Korean National Police Agency expressed optimism about the collaboration, highlighting Nigeria’s importance as Africa’s largest economy and a key player in the global financial system.

The KNPA emphasized that cyber-enabled financial crimes often transcend borders, making it necessary for law enforcement agencies to work hand-in-hand. The MoU will open opportunities for training exchanges, operational assistance, and real-time intelligence sharing to track and dismantle criminal networks.

Key Areas of the EFCC–KNPA Agreement

The newly signed MoU is designed to provide a holistic framework for fighting financial crimes across multiple fronts. It covers:

- Intelligence Sharing: Both agencies will share information on fraud syndicates, financial transaction patterns, and emerging cybercrime trends.

- Capacity Development: Training programs, workshops, and joint research will improve skills in digital policing, financial forensics, and investigative techniques.

- Joint Operations: The MoU paves the way for cross-border investigations, arrests, and prosecution of financial criminals.

- Technology-Driven Strategies: Nigeria is set to benefit from South Korea’s expertise in AI-powered digital forensics, financial intelligence units, and blockchain monitoring systems.

Why This Partnership Matters for Nigeria

Nigeria has faced long-standing challenges with financial crimes, ranging from advance-fee fraud (popularly known as Yahoo Yahoo) to sophisticated money laundering networks that channel billions of dollars out of the economy annually.

According to international watchdogs, illicit financial flows drain Africa of over $88 billion every year, with Nigeria accounting for a significant portion. These losses not only damage the economy but also tarnish the country’s reputation, making it harder to attract foreign investments.

By partnering with South Korea, a nation recognized for its advanced cyber policing systems and efficient digital crime-fighting infrastructure, the EFCC gains access to world-class tools and expertise. This collaboration is expected to:

- Strengthen Nigeria’s anti-money laundering (AML) framework.

- Improve the detection and monitoring of cryptocurrency-related crimes.

- Enhance cross-border investigations into scams targeting foreigners.

- Boost investor confidence by signaling Nigeria’s seriousness in financial transparency.

South Korea’s Track Record in Financial Crime Prevention

South Korea is widely respected for its advanced technological infrastructure and strong regulatory mechanisms against financial crimes. The country has pioneered digital forensics labs, cybercrime task forces, and blockchain transaction monitoring systems that are used to track illicit activities across digital platforms.

In recent years, the Korean National Police Agency has successfully cracked down on cryptocurrency Ponzi schemes, online fraud networks, and money laundering cartels operating in East Asia. This track record makes South Korea an ideal partner for Nigeria, where cyber-enabled crimes are rapidly expanding alongside digital adoption.

Expert Reactions to the EFCC–KNPA MoU

Security analysts and financial experts have welcomed the MoU, noting that it could mark a turning point in Nigeria’s anti-corruption and anti-cybercrime efforts.

Dr. Emmanuel Ajayi, a criminology expert, explained that:

“Financial crimes are increasingly transnational. You cannot fight them with a domestic lens alone. The EFCC’s decision to collaborate with South Korea is strategic. It means that Nigerian fraudsters who think they can hide abroad will now face a coordinated response.”

Similarly, financial analyst Aisha Lawal noted that the MoU could help Nigeria integrate better with the Financial Action Task Force (FATF) framework and improve its global compliance rankings. This, she said, would encourage foreign investment and strengthen Nigeria’s banking sector.

EFCC’s History of International Partnerships

The EFCC has previously collaborated with several international agencies, including:

- The Federal Bureau of Investigation (FBI) in the United States.

- The United Kingdom’s National Crime Agency (NCA).

- The Interpol Global Financial Crime Task Force.

- The United Arab Emirates’ Financial Intelligence Unit.

These collaborations have led to high-profile arrests, asset recoveries, and the dismantling of global scam networks. The new partnership with South Korea adds an Asian dimension to Nigeria’s growing global enforcement network.

Global Implications of the Agreement

The EFCC–KNPA MoU has far-reaching implications beyond Nigeria and South Korea. It strengthens the global coalition against financial crimes, particularly in areas such as:

- Cryptocurrency fraud and money laundering that exploit blockchain anonymity.

- Cross-border investment scams targeting individuals and corporations.

- Cyber-enabled financial terrorism, where fraud networks finance extremist activities.

By joining forces, both countries are signaling to criminals that international borders will no longer shield illicit activities.

Boosting Investor Confidence in Nigeria’s Economy

The MoU is also a win for Nigeria’s economy. For years, concerns about corruption and fraud have discouraged investors. International investors often demand proof that Nigeria is tackling systemic financial crimes before committing capital to the market.

This agreement demonstrates Nigeria’s proactive stance and could help the country secure more foreign direct investment (FDI), particularly in technology, fintech, and banking.

Conclusion: A Defining Moment in the Fight Against Financial Crimes

The signing of the MoU between the EFCC and the Korean National Police Agency marks a historic step in Nigeria’s anti-financial crime journey. It reinforces Nigeria’s global standing as a serious partner in the international fight against corruption, cyber fraud, and money laundering.

With South Korea’s advanced expertise in digital crime prevention and the EFCC’s local enforcement capacity, the partnership is expected to yield tangible results in the months and years ahead.

For Nigerians, this means stronger protections against fraud, a more credible financial system, and an economy that is more attractive to investors. For the global community, it signals that Nigeria is committed to ensuring financial crimes know no safe haven.