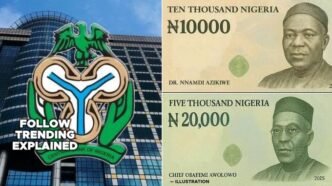

A new economic report by Quartus Economics, a leading policy and financial analytics firm, has called on the Central Bank of Nigeria (CBN) to issue higher-value currency denominations — specifically ₦10,000 and ₦20,000 notes — to address the growing inefficiencies and high transaction costs associated with cash-based payments in the country.

The recommendation, released in the firm’s Q4 2025 Nigerian Monetary Outlook, comes amid mounting concerns about the naira’s dwindling purchasing power and the rising logistical burden of handling large sums of cash for everyday transactions.

A Call for Currency Redesign Based on Economic Realities

According to Quartus Economics, the introduction of higher-denomination notes has become both economically necessary and logistically inevitable, given Nigeria’s current inflationary trends and the persistent depreciation of the naira against major global currencies.

The report, signed by the firm’s Chief Economist, Dr. Tunde Adesina, stated:

“With inflation consistently above 20 percent and the naira losing over 60 percent of its value in the past three years, the denominations currently in circulation — particularly the ₦500 and ₦1,000 notes — have become inadequate for efficient transactions. The CBN should therefore consider introducing ₦10,000 and ₦20,000 notes to restore the currency’s functional portability and reduce the cost of cash handling.”

The report further highlighted that the cost of printing and transporting currency has risen significantly due to inflation, higher security expenses, and logistical challenges faced by banks and businesses in managing large volumes of cash.

The Economic Argument for Larger Denominations

Quartus Economics argued that the need for higher-value notes is not merely cosmetic but a functional response to inflationary pressure.

At the heart of the recommendation is the idea of restoring what economists call the “transactional efficiency” of money — the ease and practicality of using currency for day-to-day trade.

Before the 2016 recession, ₦1,000 had substantial purchasing power, often enough for small retail or transport transactions. Today, that same amount barely covers short taxi fares or basic household items.

The report noted:

“When people need to carry huge sums in ₦500 and ₦1,000 denominations for ordinary purchases, money loses its efficiency as a medium of exchange. It becomes cumbersome, insecure, and expensive to move around.”

The firm added that the situation has increased security risks, as individuals and businesses are forced to move large bundles of cash for bulk payments, creating vulnerabilities to theft and fraud.

Impact on Cash Logistics and Banking Operations

The study also examined the financial strain on banks, cash-in-transit companies, and retailers. It estimated that Nigerian commercial banks spend over ₦250 billion annually on cash logistics — including transportation, sorting, and storage.

By introducing higher-value notes, Quartus Economics projects a potential 30 to 40 percent reduction in the volume of cash physically moved within the banking system.

“This would not only reduce the operational costs of cash handling but also ease the pressure on the Nigerian Security Printing and Minting Plc, which continues to grapple with the high cost of printing low-value denominations,” the report added.

Public Reaction and Expert Opinions

The proposal has already sparked wide debate among economists, policymakers, and business leaders. Some experts support the recommendation as a realistic step toward reflecting economic realities, while others caution that it could send a negative signal about Nigeria’s inflation trajectory.

Dr. Sarah Okoh, a senior economist at the University of Lagos, agreed with the principle behind the call:

“The naira’s value erosion has reached a point where higher denominations make sense for efficiency. It’s not about devaluing the currency further, but about aligning physical cash with real-world prices. Nigeria cannot keep pretending that ₦1,000 has the same purchasing power it had five or ten years ago.”

However, Professor Ayo Ajayi, a monetary policy analyst, warned that introducing ₦10,000 and ₦20,000 notes could deepen public pessimism about inflation control.

“The optics are bad. When people see larger currency notes, they psychologically expect higher inflation. This can fuel panic spending and speculative behavior in the market,” he said.

What the Central Bank Might Consider

While the CBN has not officially responded to the Quartus Economics recommendation, sources within the apex bank suggest the issue may be on the radar of the Monetary Policy Committee (MPC).

An insider familiar with CBN deliberations told this reporter that discussions on the currency structure and redesign have been ongoing since early 2025, following the widespread backlash from the 2023 naira redesign policy.

“The Bank recognizes the challenges of cash portability, especially in rural and informal markets,” the source said. “However, any decision to introduce higher denominations must balance convenience with inflationary expectations and anti-money laundering safeguards.”

The source further noted that a comprehensive feasibility study would be required before introducing ₦10,000 and ₦20,000 notes, given the economic and political sensitivity surrounding Nigeria’s currency policy.

Global and Historical Context

Nigeria would not be the first country to introduce higher denominations in response to inflation.

- India has ₹2,000 notes in circulation to support large transactions, though the government is gradually phasing them out.

- Indonesia issues 100,000-rupiah notes (roughly $6.50), while Ghana introduced a ₵200 note (approximately $14) in 2019 to simplify large cash payments.

- Across sub-Saharan Africa, several countries — including Kenya, Tanzania, and South Africa — have regularly adjusted their note structures to maintain currency efficiency as inflation evolves.

The report argues that Nigeria’s refusal to issue higher denominations has created distortions in cash-based sectors, pushing many traders and transporters toward informal payment systems that lack security and traceability.

Inflation, Naira Depreciation, and the Cost of Living

The call for larger denominations comes at a time when Nigerians are facing record-high inflation, estimated at over 29 percent in September 2025, according to the National Bureau of Statistics (NBS).

The continuous depreciation of the naira — now trading around ₦1,600 per US dollar — has significantly eroded consumer purchasing power. Everyday goods such as rice, fuel, and basic household items have tripled in price within two years, putting pressure on both urban and rural households.

Quartus Economics argues that while structural reforms are crucial to restoring the naira’s long-term stability, monetary ergonomics — the physical usability of cash — must not be ignored.

“If people need to carry ₦200,000 in ₦1,000 notes just to make a basic purchase, the physical cash system has failed. That inefficiency imposes hidden costs on the economy,” the report noted.

Potential Risks and Policy Balance

Despite the strong case for convenience and cost efficiency, monetary policy analysts warn that issuing higher denominations could have psychological and inflationary risks.

There are concerns that introducing ₦10,000 and ₦20,000 notes might encourage hoarding, money laundering, and bulk cash storage — especially in a country where digital payment infrastructure remains unevenly distributed.

To mitigate such risks, experts propose that the CBN combine the new notes with stronger cashless policies, including transaction traceability measures and limits on physical withdrawals.

“High-value notes must be accompanied by robust financial intelligence systems to prevent abuse,” said Dr. Emmanuel Eze, a financial policy consultant. “Otherwise, it could undermine the progress Nigeria has made in promoting electronic payments and anti-corruption compliance.”

Conclusion

The Quartus Economics report has reignited a critical debate about the future of Nigeria’s currency system. As inflation persists and the naira continues to lose ground, many Nigerians find it increasingly inconvenient — and costly — to transact in cash.

While the proposal to introduce ₦10,000 and ₦20,000 notes may seem radical, it reflects an undeniable truth: the naira in its current form no longer fits the realities of modern Nigeria’s economy.

Whether the Central Bank of Nigeria acts on this recommendation remains to be seen. But one thing is clear — any decision will have to carefully balance economic practicality, public perception, and monetary stability, as the country navigates one of its most challenging financial eras in recent history.