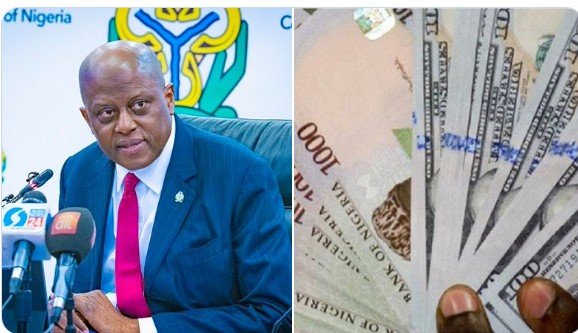

The Central Bank of Nigeria (CBN) has approved the resumption of foreign exchange (FX) sales to Bureau De Change (BDC) operators, authorising the allocation of $150,000 per week to each eligible BDC as part of renewed efforts to stabilise the naira and improve liquidity in the retail segment of the foreign exchange market.

The decision, which takes immediate effect, marks a significant intervention in Nigeria’s FX market and signals the apex bank’s determination to narrow the gap between official and parallel market exchange rates.

CBN Moves to Boost FX Liquidity

According to sources within the banking and financial services sector, the CBN’s directive allows licensed BDCs that meet regulatory requirements to access up to $150,000 weekly at a designated rate. The move is aimed at easing pressure in the retail FX market, where demand for dollars for personal travel allowance (PTA), business travel allowance (BTA), medical payments, school fees, and other invisible transactions has remained high.

The apex bank’s intervention comes amid ongoing volatility in the foreign exchange market and sustained depreciation pressures on the naira in recent months.

Financial analysts say the decision is designed to:

- Improve dollar liquidity in the informal retail segment

- Reduce speculative activities

- Support exchange rate convergence

- Restore confidence among investors and market participants

A senior financial market analyst in Lagos described the policy as “a calibrated move to provide structured liquidity to the retail end of the FX market, where demand pressures often spill over into the parallel market.”

Background: Suspension and Reforms in the BDC Segment

The CBN had previously halted FX sales to BDCs in a major policy shift aimed at addressing concerns over round-tripping, speculation, and regulatory infractions within the segment. Instead, the central bank redirected FX supply to commercial banks while embarking on reforms to sanitise the BDC ecosystem.

Over the past year, the apex bank introduced stricter licensing requirements, capitalisation thresholds, and compliance standards for BDC operators. Many operators were required to recapitalise or risk losing their licences as part of efforts to enhance transparency and curb market abuses.

The new approval for weekly FX sales appears to follow those reform measures, with eligibility likely restricted to fully compliant BDCs.

Implications for the Naira Exchange Rate

The foreign exchange market has experienced significant pressure driven by strong demand, limited supply, and macroeconomic headwinds. The widening gap between official and parallel market rates had become a source of concern for policymakers, businesses, and investors.

By injecting up to $150,000 weekly into each qualifying BDC, the CBN is expected to increase dollar availability at the retail level, potentially easing demand pressures that often push consumers toward the parallel market.

Economists suggest that if properly implemented and monitored, the measure could:

- Reduce arbitrage opportunities

- Moderate speculative hoarding of dollars

- Encourage price stability in the FX market

- Improve rate transparency

However, they caution that sustained exchange rate stability depends on broader structural factors, including oil revenue performance, foreign portfolio inflows, remittance flows, and overall macroeconomic policy consistency.

How the Weekly FX Allocation Will Work

Although detailed operational guidelines are still being circulated to market participants, industry sources indicate that:

- Each eligible BDC may access up to $150,000 per week

- FX sales must be used strictly for approved retail transactions

- Operators must adhere to strict reporting and documentation requirements

- Violations may attract regulatory sanctions

The CBN is expected to maintain close oversight of transactions to ensure that funds are not diverted for speculative purposes.

A compliance officer at a major financial institution noted that “monitoring mechanisms are likely to be tighter this time, with real-time reporting and enhanced verification processes.”

Reaction from BDC Operators

The Association of Bureau De Change Operators of Nigeria (ABCON) and other industry stakeholders have long advocated for the restoration of FX access to BDCs, arguing that the segment plays a critical role in serving retail customers who may not easily access foreign exchange through commercial banks.

BDC operators contend that the absence of direct CBN supply contributed to dollar scarcity and widened the gap between official and street rates.

Industry insiders say the new policy could revive operations for many licensed BDCs that had struggled since the suspension of direct FX allocations.

“This is a positive development for the retail market,” said a Lagos-based BDC operator. “Access to structured supply will help us meet legitimate customer demand and reduce panic buying.”

Market Analysts Weigh In

Financial experts view the CBN’s move as part of a broader strategy to deepen reforms in Nigeria’s FX market. In recent months, the apex bank has introduced measures aimed at enhancing price discovery, unifying exchange rates, and attracting foreign investment.

Market watchers believe that targeted liquidity injections, combined with transparency reforms, may help rebuild investor confidence.

However, analysts also stress that sustainable exchange rate stability requires consistent policy coordination between monetary and fiscal authorities.

“Short-term liquidity support is helpful, but long-term stability will depend on improving dollar inflows from exports, diaspora remittances, and foreign direct investment,” an economist at an investment firm stated.

Broader Economic Context

Nigeria’s economy continues to navigate inflationary pressures, rising import costs, and global economic uncertainties. The foreign exchange market remains central to macroeconomic stability, influencing import prices, inflation levels, and business operations.

Manufacturers and import-dependent businesses have expressed concern over volatile exchange rates, which complicate pricing and financial planning.

By targeting the BDC segment, the CBN appears to be addressing one of the most visible pressure points in the FX market—the retail demand segment that directly affects individuals and small businesses.

Investor and Public Sentiment

The announcement has already sparked reactions across financial markets, with investors closely monitoring its potential impact on exchange rate movements in both official and parallel markets.

If effectively implemented, the policy could reduce panic-driven demand for dollars and help stabilise expectations.

However, some market observers caution that careful supervision is essential to prevent misuse or market distortions.

Transparency, compliance enforcement, and consistent communication from the CBN will be critical in shaping public confidence in the initiative.

Looking Ahead

The success of the $150,000 weekly FX sales programme will likely depend on:

- Strict compliance enforcement

- Transparent allocation processes

- Market discipline among BDC operators

- Complementary macroeconomic reforms

Stakeholders will be watching to see whether the intervention leads to measurable convergence between official and parallel market rates in the coming weeks.

For now, the CBN’s approval signals a renewed effort to stabilise Nigeria’s foreign exchange landscape and address liquidity challenges at the retail level.

As implementation begins, further clarifications and operational details are expected from the apex bank to guide market participants.

The development marks a significant chapter in Nigeria’s evolving FX policy framework, with implications for the naira, inflation trends, investor confidence, and overall economic stability.

More updates are expected as the market reacts to the CBN’s latest intervention.