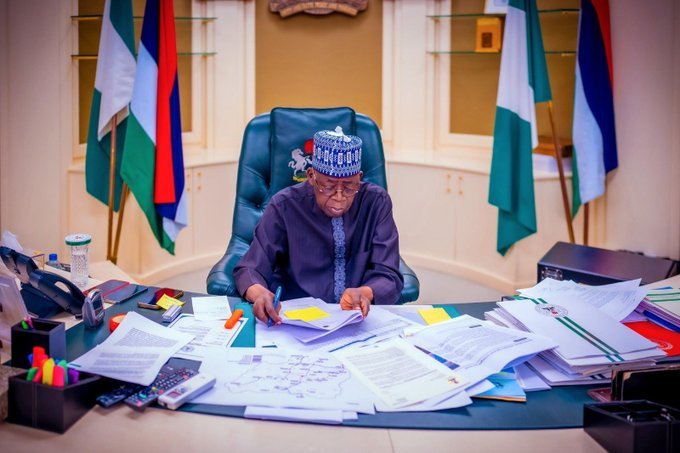

President Bola Ahmed Tinubu has requested the approval of the Nigerian Senate to secure $2.35 billion in external loans and issue a $500 million Sovereign Sukuk in the international capital market. The request, formally communicated to the National Assembly through a letter read on the Senate floor by Senate President Godswill Akpabio on Wednesday, is part of the administration’s strategy to fund the 2025 budget deficit, refinance maturing Eurobonds, and finance critical infrastructure projects across the country.

The letter, titled Request for Approval of the Federal Government’s 2025 External Borrowing Plan, outlines the Tinubu administration’s approach to managing Nigeria’s fiscal obligations while sustaining investor confidence in the nation’s debt market. According to the President, the external borrowing plan aligns with the 2025 Appropriation Act, which includes ₦9.276 trillion in new borrowings to cover part of the national budget deficit.

Breakdown of the $2.35 Billion Loan Request

In his communication to the Senate, President Tinubu explained that the $2.35 billion external borrowing would be sourced through a mix of financial instruments available in the International Capital Market (ICM), including Eurobonds, syndicated loans, bridge financing, and direct borrowings from multilateral financial institutions.

Out of the total amount, ₦1.843 trillion (approximately $1.229 billion at ₦1,500 per dollar) is intended to help finance the implementation of the 2025 Appropriation Act, while the remaining $1.118 billion is earmarked for refinancing Nigeria’s Eurobonds issued in 2018, which are due for maturity in November 2025.

Tinubu emphasized that refinancing maturing Eurobonds was a globally accepted fiscal practice designed to prevent default and maintain a positive credit profile. “The plan is to refinance the maturing Eurobonds through Eurobond issuance, bridge finance, syndicated loans, or direct borrowing as needed,” the President stated in the letter.

He assured lawmakers that the government, through the Federal Ministry of Finance and the Debt Management Office (DMO), would work closely with transaction advisers to obtain the most favorable terms possible based on prevailing global market conditions. According to the President, Nigeria’s status as a regular participant in international debt markets gives it an advantage in securing competitive rates.

Senate’s Response and Legislative Process

Following the reading of the President’s letter, Senate President Akpabio referred the request to the Senate Committee on Local and Foreign Debts, chaired by Senator Aliyu Wamakko (APC, Sokoto North). The committee has been directed to review the proposal thoroughly and present its report within one week for consideration and approval.

Senate observers say the legislative review will focus on the terms, interest rates, repayment plans, and expected impacts of the new loans on Nigeria’s debt sustainability framework. The lawmakers are also expected to weigh the proposal against the current public debt figures and the government’s medium-term debt management strategy.

Nigeria’s Rising Borrowing Needs and Debt Management

Nigeria’s 2025 budget, estimated at over ₦29 trillion, includes a projected deficit of ₦9.276 trillion. To close this gap, the government plans to rely on both domestic and external borrowings. The proposed $2.35 billion external borrowing forms part of this fiscal framework, designed to balance the budget while meeting key developmental and infrastructural goals.

As of mid-2025, Nigeria’s total public debt stock stood at approximately ₦121 trillion, including both domestic and external obligations. Despite the rising debt levels, the Tinubu administration insists that borrowing remains necessary to finance critical investments and prevent an economic slowdown.

Financial experts note that refinancing Eurobonds instead of outright repayment allows the government to manage liquidity pressures while preserving foreign reserves. However, they also caution that Nigeria’s growing dependence on debt requires stronger revenue generation and fiscal discipline to ensure long-term sustainability.

$500 Million Sovereign Sukuk Proposal

In addition to the loan request, President Tinubu also sought Senate approval to issue a stand-alone Sovereign Sukuk worth up to $500 million in the international capital market. This will mark Nigeria’s first foreign-currency-denominated Sukuk issuance, signaling a major step in diversifying the country’s debt instruments and attracting Islamic investors from across the Middle East and Asia.

The proposed Sukuk, which could be backed by the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC)—a member of the Islamic Development Bank (IsDB) Group—aims to raise funds for key infrastructure projects, including roads, bridges, and transportation networks.

Tinubu highlighted Nigeria’s successful history with domestic Sukuk bonds, which have raised ₦1.392 trillion since 2017. Those funds have been deployed to finance over 80 major road and infrastructure projects nationwide. By extending the Sukuk issuance to the international market, the government hopes to deepen Nigeria’s sovereign debt market and expand the pool of global investors.

“There is a need to pool resources from external sources to complement domestic issuance and help bridge infrastructure funding gaps,” Tinubu noted in the letter. “It is also important to open new funding sources and diversify the investor base for the Federal Government.”

Economic Implications and Market Reactions

Analysts view the dual proposal as a strategic move to stabilize Nigeria’s finances amid high expenditure pressures and slowing revenue growth. The $2.35 billion external borrowing would provide immediate liquidity support for the 2025 budget, while the $500 million Sukuk could attract ethical investors seeking stable, asset-backed instruments.

The move also aligns with the Tinubu administration’s broader goal of strengthening Nigeria’s credit profile and re-engaging international investors following years of subdued activity in the country’s bond markets. Nigeria last accessed the Eurobond market in 2021, raising $4 billion in what was then one of the largest single issuances by an African country.

However, some economists caution that the government must exercise prudence in its borrowing strategy to avoid escalating debt servicing costs. According to recent data from the Debt Management Office, Nigeria spent over 70% of its revenue on debt servicing in 2024, underscoring the fiscal pressure created by large borrowings.

They argue that the key to sustainability lies in ensuring that borrowed funds are invested in revenue-generating projects capable of stimulating growth, creating jobs, and expanding the tax base. Transparency and accountability in the management of loan proceeds will also be crucial to maintaining investor confidence.

Looking Ahead

If approved, the new external borrowings and Sukuk issuance will reinforce the Tinubu administration’s fiscal framework for 2025 and beyond. The funds are expected to help implement priority programs under the Renewed Hope Agenda, focusing on infrastructure, energy, transportation, and social investments.

With the Senate Committee on Local and Foreign Debts expected to present its report soon, attention will now shift to the legislative debate and eventual approval process. The outcome will determine how quickly the Federal Government can proceed with negotiations and access the international capital markets.

For now, President Tinubu’s proposal underscores a continuing reliance on external financing as Nigeria seeks to navigate fiscal challenges, sustain growth momentum, and strengthen its economic resilience amid global uncertainties.